Understanding Flood Insurance

When we think of flooding – images of cars submerged in water and people kayaking down their water-filled streets come to mind. But, flood damage doesn’t have to that extreme to cause serious, costly damage. Just one inch of water in your home could do quite a bit of damage.

According to the federal government, flood insurance claims averaged over $2.9 billion per year from 2002 to 2011.

Today, we’ll help you understand your flood risk and what a flood insurance policy can cover in your Florida home or commercial property. Let’s start with this explanation of Florida flood insurance from our guest writer:

Florida Flood Insurance: How Residents Can Obtain and Benefit from It

Flooding is a tragic event that damages countless homes and can cause injuries to hundreds of people each year. What many individuals do not know is that flooding can occur just about anywhere in the United States. Excess rain and broken drainage systems are just a few of the many causes of flooding all across the country. Despite the fact that flooding can occur anywhere in the United States, there are some areas that are more prone to flooding than others.

Hurricane can bring high winds, tornadoes, thunderstorms, and large amounts of rainfall. When it comes to a hurricane it has been said that flooding is a large concern in Florida. Many individuals are unable to pay out-of-pocket to repair their flood damaged homes. That is why a large number of Florida residents obtain flood insurance coverage.

Insurance anywhere in the United States is important, but Florida flood insurance could be on the most important. Every summer Florida is at risk for multiple hurricanes, excess rainfall, and flooding. That is why it is important that all residents obtain Florida flood insurance.

As with car insurance, homeowner’s insurance, and life insurance, there are options when it comes to selecting a coverage plan. A large number of individuals mistakenly believe that all flood insurance coverage is the same. The cost of Florida flood insurance is likely to vary. The National Flood Insurance Program, which offers affordable flood insurance to all Americans, takes a number of factors into consideration when deciding on coverage plans.

The Federal Emergency Management Agency (FEMA) has developed Flood Rate Maps. These maps are used by the National Flood Insurance Program to determine the risk associated with providing flood insurance to a specific household. In addition to the Florida Flood Insurance Rate Maps, the National Flood Insurance Program may also take into consideration what Florida has done to prevent or limit the amount of flooding that occurs in their area.

Florida flood insurance that is backed by the National Flood Insurance Program and the Emergency Management Agency (FEMA) is sold directly through the program or through a licensed agent. Purchasing Florida flood insurance from a licensed agent may save Florida residents additional money. Due to state laws on rebates, flood insurance agents are able to offer insurance coverage for a discounted price. In fact, AmeriFlood is currently offered a 12% upfront rebate discount on all plans.

Florida flood insurance is a must have for all state residents. When the next hurricane makes landfall, do not be unprotected. You are encouraged to contact a flood insurance agent today to obtain a free flood insurance quote.

— Jim Stacey is a writer for Ameriflood where you can find Florida flood insurance at a special discount price.

###

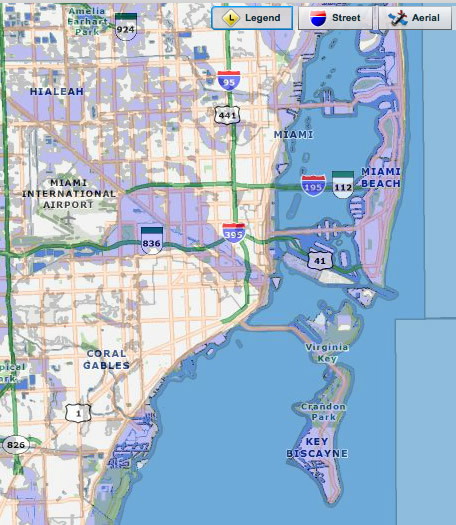

Flood Maps for Miami-Dade County

Miami-Dade County helps Florida residents understand their flood risks with interactive maps. Here’s a quick look at the map for our county:

You can see the entire map, find the risk for your home or business and important details about Miami-Dade County’s participation in the national flood insurance program at the Miami-Dade website.

Flood Damage in Miami, Florida

If you have experienced flooding and water damage in Miami, Florida – we can help you asses the damage and prepare a claim that will have you on your way to rebuilding and getting back to normal. Working with a Public Adjuster can significantly increase the amount of the claim you’re awarded – so let us help you recover as much as possible.

Sources:

- http://www.miamidade.gov/development/flooding-maps.asp

- http://EzineArticles.com/212196

- http://gisweb.miamidade.gov/floodzone/

- http://www.floodsmart.gov/floodsmart/pages/flood_facts.jsp